Income Tax For Nursing Home Residents On Medicaid . under fair deal, you pay a certain amount towards the cost of your care and the hse pays the rest. The assessment will not take the income. relief on nursing home expenses is available at your highest rate of income tax. you claim tax relief for nursing home fees under the general scheme for tax relief on medical expenses. you can claim tax relief on the nursing home expenses you pay for. q can i claim tax back on nursing home fees and medical costs? if you are paying for nursing home care, you may be able to claim income tax relief on the expenses. Nursing home (fair deal) loan scheme. A under the general scheme for tax relief on medical. You can claim tax relief on. the contribution is equal to 80% of your assessable income and 7.5% of the value of any assets you own per annum.

from www.formsbank.com

you claim tax relief for nursing home fees under the general scheme for tax relief on medical expenses. the contribution is equal to 80% of your assessable income and 7.5% of the value of any assets you own per annum. Nursing home (fair deal) loan scheme. under fair deal, you pay a certain amount towards the cost of your care and the hse pays the rest. The assessment will not take the income. A under the general scheme for tax relief on medical. q can i claim tax back on nursing home fees and medical costs? you can claim tax relief on the nursing home expenses you pay for. You can claim tax relief on. relief on nursing home expenses is available at your highest rate of income tax.

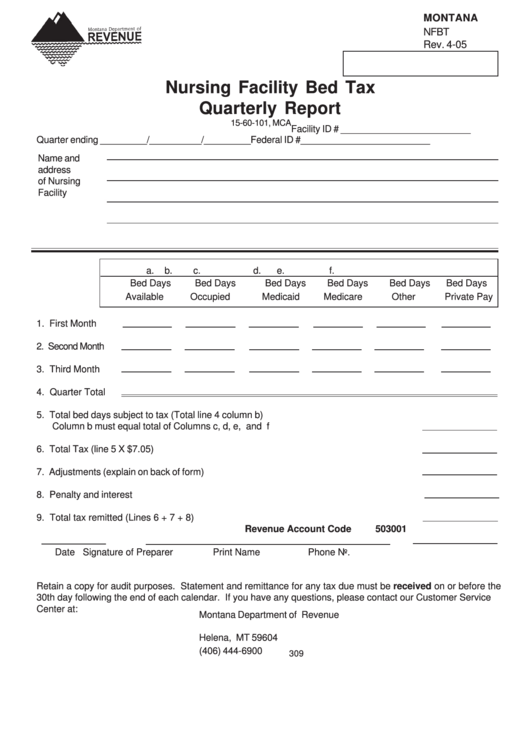

Form Nfbt Nursing Facility Bed Tax Quarterly Report Form Montana

Income Tax For Nursing Home Residents On Medicaid the contribution is equal to 80% of your assessable income and 7.5% of the value of any assets you own per annum. you claim tax relief for nursing home fees under the general scheme for tax relief on medical expenses. The assessment will not take the income. A under the general scheme for tax relief on medical. if you are paying for nursing home care, you may be able to claim income tax relief on the expenses. under fair deal, you pay a certain amount towards the cost of your care and the hse pays the rest. You can claim tax relief on. relief on nursing home expenses is available at your highest rate of income tax. Nursing home (fair deal) loan scheme. q can i claim tax back on nursing home fees and medical costs? you can claim tax relief on the nursing home expenses you pay for. the contribution is equal to 80% of your assessable income and 7.5% of the value of any assets you own per annum.

From www.usnotarycenter.com

How to apply for IRS Form 6166 Certification of U.S. Tax Residency? Income Tax For Nursing Home Residents On Medicaid The assessment will not take the income. you claim tax relief for nursing home fees under the general scheme for tax relief on medical expenses. the contribution is equal to 80% of your assessable income and 7.5% of the value of any assets you own per annum. under fair deal, you pay a certain amount towards the. Income Tax For Nursing Home Residents On Medicaid.

From www.premack.com

Getting a Job under Medicaid’s rules Income Tax For Nursing Home Residents On Medicaid the contribution is equal to 80% of your assessable income and 7.5% of the value of any assets you own per annum. q can i claim tax back on nursing home fees and medical costs? The assessment will not take the income. Nursing home (fair deal) loan scheme. you claim tax relief for nursing home fees under. Income Tax For Nursing Home Residents On Medicaid.

From www.mcclatchydc.com

Shifting population in California nursing homes creates ‘dangerous mix Income Tax For Nursing Home Residents On Medicaid you claim tax relief for nursing home fees under the general scheme for tax relief on medical expenses. under fair deal, you pay a certain amount towards the cost of your care and the hse pays the rest. q can i claim tax back on nursing home fees and medical costs? You can claim tax relief on.. Income Tax For Nursing Home Residents On Medicaid.

From tutore.org

Printable Medicaid Application Master of Documents Income Tax For Nursing Home Residents On Medicaid The assessment will not take the income. A under the general scheme for tax relief on medical. under fair deal, you pay a certain amount towards the cost of your care and the hse pays the rest. q can i claim tax back on nursing home fees and medical costs? you claim tax relief for nursing home. Income Tax For Nursing Home Residents On Medicaid.

From www.kff.org

Medicaid in an Era of Health & Delivery System Reform Provider Rates Income Tax For Nursing Home Residents On Medicaid q can i claim tax back on nursing home fees and medical costs? you claim tax relief for nursing home fees under the general scheme for tax relief on medical expenses. You can claim tax relief on. relief on nursing home expenses is available at your highest rate of income tax. Nursing home (fair deal) loan scheme.. Income Tax For Nursing Home Residents On Medicaid.

From www.illinoiscares.org

Nursing Home Residents' Rights Illinois Citizens for Better Care Income Tax For Nursing Home Residents On Medicaid You can claim tax relief on. you claim tax relief for nursing home fees under the general scheme for tax relief on medical expenses. relief on nursing home expenses is available at your highest rate of income tax. under fair deal, you pay a certain amount towards the cost of your care and the hse pays the. Income Tax For Nursing Home Residents On Medicaid.

From roguemedic.com

Reducing Unnecessary Hospitalizations of Nursing Home Residents Rogue Income Tax For Nursing Home Residents On Medicaid the contribution is equal to 80% of your assessable income and 7.5% of the value of any assets you own per annum. relief on nursing home expenses is available at your highest rate of income tax. Nursing home (fair deal) loan scheme. You can claim tax relief on. under fair deal, you pay a certain amount towards. Income Tax For Nursing Home Residents On Medicaid.

From www.thegypsynurse.com

What Really is a Tax Home as a travel nurse while on assignment Income Tax For Nursing Home Residents On Medicaid q can i claim tax back on nursing home fees and medical costs? Nursing home (fair deal) loan scheme. the contribution is equal to 80% of your assessable income and 7.5% of the value of any assets you own per annum. under fair deal, you pay a certain amount towards the cost of your care and the. Income Tax For Nursing Home Residents On Medicaid.

From www.wasatch.org

Medicaid Expansion and WMH Wasatch Behavioral Health Income Tax For Nursing Home Residents On Medicaid q can i claim tax back on nursing home fees and medical costs? Nursing home (fair deal) loan scheme. A under the general scheme for tax relief on medical. You can claim tax relief on. relief on nursing home expenses is available at your highest rate of income tax. the contribution is equal to 80% of your. Income Tax For Nursing Home Residents On Medicaid.

From www.kff.org

Medicaid's Role in Nursing Home Care KFF Income Tax For Nursing Home Residents On Medicaid A under the general scheme for tax relief on medical. under fair deal, you pay a certain amount towards the cost of your care and the hse pays the rest. relief on nursing home expenses is available at your highest rate of income tax. q can i claim tax back on nursing home fees and medical costs?. Income Tax For Nursing Home Residents On Medicaid.

From www.templateroller.com

Nursing Home Checklist Fill Out, Sign Online and Download PDF Income Tax For Nursing Home Residents On Medicaid The assessment will not take the income. the contribution is equal to 80% of your assessable income and 7.5% of the value of any assets you own per annum. Nursing home (fair deal) loan scheme. q can i claim tax back on nursing home fees and medical costs? A under the general scheme for tax relief on medical.. Income Tax For Nursing Home Residents On Medicaid.

From seniorjustice.com

Florida's Pending Medicaid Change Spells Trouble Income Tax For Nursing Home Residents On Medicaid if you are paying for nursing home care, you may be able to claim income tax relief on the expenses. The assessment will not take the income. the contribution is equal to 80% of your assessable income and 7.5% of the value of any assets you own per annum. under fair deal, you pay a certain amount. Income Tax For Nursing Home Residents On Medicaid.

From www.medicaidtalk.net

Medicaid Home Health Care New York Income Tax For Nursing Home Residents On Medicaid The assessment will not take the income. q can i claim tax back on nursing home fees and medical costs? relief on nursing home expenses is available at your highest rate of income tax. You can claim tax relief on. A under the general scheme for tax relief on medical. the contribution is equal to 80% of. Income Tax For Nursing Home Residents On Medicaid.

From www.researchgate.net

Percentage of nursing home residents, by sources of payment at Income Tax For Nursing Home Residents On Medicaid under fair deal, you pay a certain amount towards the cost of your care and the hse pays the rest. q can i claim tax back on nursing home fees and medical costs? relief on nursing home expenses is available at your highest rate of income tax. Nursing home (fair deal) loan scheme. you claim tax. Income Tax For Nursing Home Residents On Medicaid.

From www.researchgate.net

(PDF) Medicaid Nursing Home Payment and the Role of Provider Taxes Income Tax For Nursing Home Residents On Medicaid The assessment will not take the income. you can claim tax relief on the nursing home expenses you pay for. under fair deal, you pay a certain amount towards the cost of your care and the hse pays the rest. if you are paying for nursing home care, you may be able to claim income tax relief. Income Tax For Nursing Home Residents On Medicaid.

From slideplayer.com

Hospital Care Physician & Clinical Services Retail Prescription Drugs Income Tax For Nursing Home Residents On Medicaid relief on nursing home expenses is available at your highest rate of income tax. if you are paying for nursing home care, you may be able to claim income tax relief on the expenses. You can claim tax relief on. you can claim tax relief on the nursing home expenses you pay for. A under the general. Income Tax For Nursing Home Residents On Medicaid.

From trybeem.com

Nursing Home Residents on Medicaid Tax Filing Key Pointers Income Tax For Nursing Home Residents On Medicaid A under the general scheme for tax relief on medical. Nursing home (fair deal) loan scheme. relief on nursing home expenses is available at your highest rate of income tax. the contribution is equal to 80% of your assessable income and 7.5% of the value of any assets you own per annum. q can i claim tax. Income Tax For Nursing Home Residents On Medicaid.

From voxvine.com

Medicaid allowances fail to meet basic needs of nursing home residents Income Tax For Nursing Home Residents On Medicaid you can claim tax relief on the nursing home expenses you pay for. You can claim tax relief on. you claim tax relief for nursing home fees under the general scheme for tax relief on medical expenses. q can i claim tax back on nursing home fees and medical costs? under fair deal, you pay a. Income Tax For Nursing Home Residents On Medicaid.